In the first quarter of 2022, Coupang became the highest earning e-commerce service in South Korea, surpassing Naver for the first time. Now Coupang is the most popular eCommerce platform in Korea, bringing in 30.66 trillion won in revenue in 2024 (Statista).

E-commerce Market Share in 2025

As mentioned above, Coupang leads the eCommerce market in Korea. Naver has the 2nd highest market share in eCommerce in Korea, having 27.2% of the respondents cite it as their most commonly used eCommerce platform, as compared to Coupang’s 37.7% in 2023 (Korea Herald).

The third company listed after Coupang and Naver was G-Market, followed by 11th Street (Korea Herald).

Coupang saw $7.3 billion in revenue for the second quarter of 2024, a 13% increase from the previous year. Naver earned 2.53 trillion KRW that same quarter, which was actually a .03% decrease from the previous quarter.

Coupang saw a 28% increase since the first quarter of 2021, passing from 7,517.2 billion won to 9,622.6 billion. It was quite a steeper rise than Naver, which increased by 11%.

The trends in the distribution industry predict that Coupang will continue to expand in the following years, and it is actively investing in logistic centers to consolidate its image as the “Next-day delivery” company.

On the other side, Naver’s revenue mainly comes from Naver Store, Naver Webtoon, and Music.

Learn how to use Coupang and increase your brand awareness by reading our guide to Coupang ads.

Online Shopping Landscape in South Korea 2025

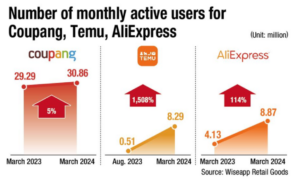

Chinese eCommerce platforms, such as AliExpress and Temu, with a low price strategy have recently entered the market and have made quite the splash. AliExpress surged to the 2nd most viewed eCommerce site in Korea this March, with 8.87 million monthly active users (Korea Times).

The rate of growth of these sites are also far outpacing domestic platforms, as seen in the graph below from the Korea Times.

However, it is important to note that Coupang is still way ahead of AliExpress, and that the difference in growth rates can be explained by the fact that Coupang is already established in the market, while Temu and AliExpress are still in the diffusion phase.

Still it will be interesting to see how this trend progresses in the coming months. Especially as it relates to these sites’ main strategy, price competitiveness, and what this might be signaling for Korean spending habits.

Sources: Huffingtongpost Kr, Yonhap.